Tower Of London: 22 Towers

Tower of London, You can get the best Tower of London Tour on our place. unlike other towers in London, is actually a group of structures. Towers in the Tower of London include:

1.Beauchamp Tower

Thomas Beauchamp earl of Warwick was a prisoner in the fourteenth century when Edward I built this tower. It is in this tower that some of the finest inscriptions from Tudor prisoners were found. Many of them are heraldic symbols, while others simply have the word “Jane” spelled out. This is a reference to Lady Jane Grey who, at 17 years old, was sentenced to death in 1554. Her husband, Lord Guildford Dudley was likely the person responsible for carving this name into the wall.

Bell Tower

Richard the Lionheart constructed the Bell Tower in 1534, making it the second oldest tower. The future Elizabeth I was also imprisoned at the Tower in 1534.

3. Bloody Tower

Originally known as the Garden Tower the Bloody Tower became more popular in the sixteenth Century because this was where young princes who were sons to Edward IV would have been put to death by their evil Uncle. Undoubtedly, the Bloody Tower is home to other murders. It is believed that the Jacobean Courtier and Writer Sir Thomas Overbury, who was murdered by a killer enema at the behest of a powerful Noblewoman he crossed on a whim.

4.Bowyer Tower

In accordance with tradition, it was in the Bowyer Tower that Clarence Duke, Edward IV’s troublesome and erratic brother, Richard III was drowned. Shakespeare’s Richard III depicts the murder, but his location is described as simply ‘The Tower. London’.

Brick Tower

Sir Walter Raleigh was jailed at the Brick Tower by Elizabeth I in 1592 for seducing Elizabeth Throckmorton (one of Elizabeth I’s Maids of Honour), making her pregnant, then secretly wed her. Before marrying, Elizabeth’s courtiers were supposed to get her approval. Even though Sir Walter Raleigh had been released from prison, the Raleighs remained in shame for many decades.

Broad Arrow Tower

Broad Arrow Tower, part of Henry Ill’s Tower extension in the middle thirteenth century. Named after the emblem that was stamp on goods showing they were Crown Property.

Byward Tower

Possibly named after its proximity to the Warders’ Hall. Every night the chief warder will emerge from the Tower to perform the Ceremony of the Keys, before locking the Tower complex.

Tower of the Constable

It was the home of the Tower Constable in the past. Today, it houses a model of London’s Tower of London during the Middle Ages.

Cradle Tower

Cradle, which was constructed in the middle of 14th-century France, gets its name from a type of hoist used to raise boats up the river and to the entrance of the Cradle. John Gerard, a Jesuit priest who fled to France in 1597 from the Cradle Tower.

Develin Tower

Develin Tower is located the farthest East of all the towers. This one was never open to public. The drawbridge used to connect the Develin Tower to Iron Gate, now demolished.

Established retailers can take advantage of OTT advertising to increase their chances of success

The days of promotional content being only intended for direct response advertising are gone. OTT (Overthe-Top) advertising is a new, modern way to use them. It is a great opportunity for established retailers to advertise. It works in the same way as a search engine, social networking, and affiliate marketing. It allows for audience targeting. This is precisely what gives such commercials an edge over traditional TV advertising. You can get the best guide on ctv advertising.

What makes OTT advertising a part of digital market strategy? Internet marketing, as you may remember, is all about using digital technologies and the World Wide Web to promote product/service promotions. OTT is based on a similar concept. It offers content (movies, webseries and TV content) via smart TVs and streaming devices as well as mobiles. The common element? Internet. It would be unfair to exclude OTT ads from digital marketing strategies. Forbes, the popular magazine, has also written a post on the topic. This establishes a connection between them.

But this is not where we want to shine the light. Today we will be discussing OTT ads and why they are a potential opportunity for online retailers.

OTT is widely utilized

Covid-19 has imposed restrictions on people’s movement. OTTs are the most popular entertainment source, as everyone has chosen to stay in their homes. This has allowed subscribers to see more OTT ads than their Instagram feed. This allows you to predict the movements of your consumers. OTT ads are the best investment for retailers if you want to remain competitive in the market.

Targeting is simple

OTT allows retailers to gather demographic information from streaming services and then combine it with data gleaned from loyalty programs or mailing lists to create cross-device graphing. This information can be used to create OTT ads for customers.

Let’s suppose, for instance, that you have the geofencing information of your competitor. You can then get a sense of who their customers are and what they’ve bought. You can now promote the benefits of buying the same products in your retail store by targeting and/or retargeting. This OTT commercial will assist you in your job. This is exactly how to capture the market.

The Ultimate Science and Art of Building a Gaming Setup

In order to deliver a truly unique gaming experience, it is important that aesthetics and performance are combined. Here, we will examine both scientific and artistic factors that help create a superior gaming environment. For a comprehensive guide on how to elevate your gaming setup in 2023 and potentially win some amazing prizes, Check Giveaway contests

1. The Hardware Foundation, Choosing Your Arsenal

It is important to note that the gaming console itself forms the basis of any setup. You should choose a gaming console that matches your style of gaming, whether you want a high-performance gaming PC. The hardware you choose should be able to handle your favorite games, providing smooth performance, good graphics, and low latency.

2. The Visual Gateway – Monitors and Displays

You can choose the monitor to suit your needs. The gaming experience is enhanced by factors such as high refresh rate, slow response times, or superior resolution. Well-chosen monitors minimize motion blur to help immerse you in virtual reality.

3. Gaming Peripherals: The Command Center

The gaming peripherals you use, such as precision mouses, mechanical keyboards, and headsets with immersive audio, will give you the control that is needed. RGB peripherals that are customizable enhance gaming and also personalize your setup.

4. Comfort Zone – Ergonomics for Comfort

It is important to create a comfortable atmosphere for gaming, as sessions can go on for several hours. Ergonomic chairs and adjustable workstations help maintain correct posture during long gaming sessions, and can reduce discomfort and strain.

5. The Aesthetics – Personalization and Ambiance

It is only through personalization that your gaming space can truly become a sanctuary. Use themes, collectibles, artwork or posters that represent your gaming style. RGB ambient lighting can be customized to set the mood and add an extra level of immersion.

6. The Soundscape Audio Enhancement

In order to have a great gaming experience, audio quality is essential. The use of high-quality speakers or headphones creates a 3-dimensional audio experience, which allows the player to immerse themselves in the game.

7. Up-to-date Maintenance

In a rapidly evolving industry, staying informed on the newest hardware and updates is crucial. Keep your system competitive by performing timely maintenance, updating it regularly and paying attention to emerging gaming trends.

Fungible Tokens NFT Games

Non-Fungible Tokens – also known as NFTs – have revolutionized the game industry. This article explores NFT Gaming Trends and the impact it has had on the industry.

1. Virtual Realms and the Authentication of Ownership

NFTs create a fundamental shift in the way we think about ownership. NFTs provide players with a way to own their digital possessions without any doubt. Each NFT offers players a tangible way to prove their possessions.

2. This is what attracts us to scarcity.

With NFTs, the notion of scarcity comes to the forefront. NFTs provide virtual items with real-world worth. Gamers will be able to own and collect rare digital in-game objects, making them collectibles.

3. “Seamless integration across multiple platforms”:

NFTs extend beyond individual platforms and games. These tokens work across a variety of gaming ecosystems, as long as they adhere to the same blockchain standards.

4. Empowering the Players and Creators

NFT gaming empowers players as well content creators. NFTs allow players to take part in defining the in-game economy through trading. Content creators including musicians, developers and artists can tokenize and monetize their work, thus ensuring that they are compensated and rewarded fairly for their contribution.

5. The Transition to Player Driven Economy:

NFTs play a key role in the development of a player-driven economy. Gamers can now influence the in-game market, value of items and dynamics of trade. This move to a player-driven economy marks a radical shift in the gaming sector.

6. The Challenges to Sustainability and How To Address Them

NFT-based gaming offers exciting possibilities, but also challenges. For example, there are concerns regarding the sustainability of blockchains due to their energy consumption. There are also issues regarding copyright or ownership. These challenges can be overcome by adopting responsible practices, and through innovation.

7. NFT Gaming Future:

NFT gaming’s future holds great promise. With the advancement of technology and growing mainstream adoption, players can enjoy an immersive, dynamic, and interconnected gaming experience. This future promises enhanced creativity and collaboration within the gaming community.

What Is ‘Effective Communication’?

Efficient communication is really a considerably esoteric thought that is usually applied to organization management. It could possibly, nonetheless, quickly use to our own lives as well. How to effectively communicate with others?, you can learn more with John De Ruiter in here.

Put merely, effective interaction aims at strengthening our knowledge of the emotional content material (*taps head and does a foul Bruce Lee impersonation) at the rear of any provided data. Theoretically, this being familiar with tends to make us a lot more empathic and thus greater equipped to relate to our spouses, co-workers, companies and buddies.

Powerful interaction, then, aims at fostering a further comprehending concerning communicators, by creating a more powerful emotional resonance.

Specialists inside the matter sustain which the 1st step toward turning into a more productive communicator (in case you desire to, obviously) is usually to develop into a far better listener. You may make this happen by totally focusing on the speaker (versus getting distracted, or intentionally distracting on your own), not interrupting them and brazenly demonstrating an fascination in exactly what the speaker should say.

The subsequent phase, maintains that the use of open up physique language (e.g. not crossing your arms) and emphasizing some extent by way of your whole body (like tapping your head to point contemplating ahead) is additionally very essential to productive interaction.

Stage 3 is always to concentrate on and therefore far better take care of, your worry. A pressured man or woman, even when their outward demeanour looks enjoyable adequate, presents off loads of panic, from overall body language to posture, so it is advisable to contend with your anxieties privately ahead of dealing with other individuals (where by attainable).

Needless to say, efficient conversation is basically emotion-centric for a strategy and therefore the last point introduced up via the posting is to enhance your individual emotional recognition. In essence, this can be the comprehension of by yourself and what can make you tick. It seems clear, even effortless, although the fact is the fact that many of us do not possess a clue. If you end up entrenched in petty squabbles or consistent bickering with the close friends, spouse, spouse and children or colleagues, then there may be a great possibility that there’s something deeper that’s bothering you. Which has a larger emotional comprehension of your self, not only will you have the capacity to steer clear of potentially stress-inducing situations, but you should also have the capacity to identify patterns in others that you’ve got found in by yourself, making it possible for you to definitely turn into additional empathic and, ultimately, an improved communicator.

Physical Therapy and Rehabilitation Services

They are used to treat disorders of the musculoskeletal and physical system. They are primarily concerned with relieving pain, preventing permanent disability, and returning injured people to self-sufficiency and productivity. Physical therapy and rehab services include evaluating, diagnosing, and treating disorders in the musculoskeletal systems so that patients are able to resume an active lifestyle can you overdose on shrooms.

Patients who have suffered from severe injuries or accidents need physical therapy to regain their mobility, flexibility, and coordination. Physical therapy and rehabilitation can help with conditions such as permanent disabilities due to accidents, strokes and traumatic brain injury, as well birth defects, developmental delays, muscle weakness and brain injuries.

Physical therapists use techniques like strength training, stretching, balance and coordination exercises, cold packs and hot compresses as well as electrical stimulation and ultrasound therapy to help patients regain normal function. Physical therapy is classified in a variety of ways, including orthopedic physical therapy and geriatric therapy.

Guitar Building Kits: A World of Guitar Building Kits

You may have dreamed that you could create your own unique guitar to suit your style. The guitar building kit has made this dream more accessible. They allow aspiring guitarists and DIY lovers to take on the rewarding task of building their instrument. The world of guitar kits will be explored in this article. Benefits, processes, and satisfaction are all discussed.

Guitar Building Kits Have Gained Popularity: Guitar Building Kits have grown in popularity over the past few years. The kits offer an affordable alternative to high-end instruments while allowing for personalization and creativity. No matter if you are a professional or beginner guitarist, these kits will help you gain a better understanding of how the guitar is constructed and works. This allows you to develop a closer relationship with your guitar.

These components are included in a guitar kit. This may include pre-carved bodies, fretboards, electronics, pickups, hardware and hardware. Certain kits include additional finishing materials like paint, stain, or lacquer. There are many options to choose from, including the types of woods, pickups, and hardware that best suit your sound and aesthetic needs.

The Construction Process: Building from a Kit is a process which requires attention to detail and basic woodworking knowledge. Each stage is outlined in the instructions included with most kits. Each step is crucial to the finished product, whether it’s sculpting the body or neck or installing electronics and hardware. It may initially seem overwhelming, but many people find it rewarding.

Customization and Individualization: Building a guitar using a kit allows you to create a unique instrument. The type of wood you choose, as well as the finish and the hardware can be customized to your taste. Customization allows you to make a guitar unique and personalised, reflecting your musical taste.

It’s a Joy to Play Your Own Creation Once the building is complete, you can begin the fun part – play your handcrafted guitar. Strumming the first note on a guitar you built yourself brings a sense of satisfaction unlike any other. The satisfaction of building your own guitar is unmatched.

Unlock Knowledge: Quench Your Curiosity With Quick and Intelligible Answers on Any Topic

The age of information has made it easier to find answers and satisfy curiosity. Anyone can access a wealth of knowledge with question-and-answer platforms. They are able to seek expert opinion and receive intelligent responses on questions covering all topics. If you are a student or professional looking for valuable information, then these platforms can be a good way to get it.

Power of Question and Answer Platforms

The digital revolution has changed the way we learn. Quora Answers and Stack Exchange are virtual communities that connect users from around the world with a variety of expertise. Asking questions allows users to tap into collective intelligence, receiving answers from those with experience, knowledge, and expertise.

Versatility: an Open Platform for all Subjects

The platforms that allow you to ask questions and receive answers cover a broad range of subjects. Experts and enthusiasts are available to help you with everything from science to literature to history. You can ask questions and get insightful responses by people who are knowledgeable about the topic or have experience in it.

Quick Responses: Knowledge at Your Fingertips

Q&A platforms are known for their speedy responses. These platforms offer intelligent responses in minutes, unlike traditional research methods that can require hours to sift through large amounts of data. Using the vast number of active users, even complicated questions can be answered quickly.

Educating Communities Through Interaction

Q&A platforms encourage a sense of community, which allows users to participate in discussion, swap viewpoints, or collaborate with other like-minded people. In addition to enhancing the understanding of topics, these interactions also enable users to gain new perspectives and develop their critical thinking.

Perfume for Women: What to Look For

The beauty of women is a global concern. Fashion is a global industry that depends on the choices and trends made by women. Women’s choices influence the entire fashion industry, from jewelry to dresses to cosmetics and fabrics. When fashion analysts conduct polls and surveys, they gain information about women’s preferences in fabric, makeup kits, jewelry, wedding accessories and scents. The opinions and suggestions are translated into the production of popular products that are loved by pheromone women’s perfume around the globe. It is the women that are driving fashion.

women’s perfume is available in many different varieties, and the most popular brands are made exclusively for women. The perfumes were created with the female consumer in mind. They are designed to appeal to their tastes and preferences, as well as their feminine aura. Most of the time, men give perfumes to women as a gift. Some perfume companies offer a range of women’s products. These branded gifts can be sent in a pack.

Men consider many factors when they go to purchase for women. This includes the age of the women, their taste, how they dress, whether or not she is loyal to a particular brand, as well as any recent perfumes that are in fashion. Different women from different countries and locations have different preferences, as do different age groups. Companies that manufacture perfumes launch marketing campaigns and advertisements in various regions based on social norms, domestic trends and shopping habits. A company that has just launched its latest product in France may also launch another brand at the exact same time in Hong Kong. This difference can be attributed to brand loyalty or regional norms.

If you are looking for a present to give a woman, perfumes and other precious items should be considered. Women consider themselves incomplete without make-up. The majority of make-up companies now focus on healthier products such as skincare face creams and shampoos.

They are usually very concerned about how they look and appear. Women are very conscious of their skin. The prefer healthy skin care products that do not harm their natural skin. The use of natural make-up has increased due to this awareness. This trend has changed the direction of many cosmetics firms, and they are now all producing herbal cosmetics.

How To Create A Reliable Estimate For Construction

You should consider a building estimate if you’re planning to build a laid out foundation. The construction estimate allows you to assess whether you are able to afford the building materials and labor costs required for a specific house design. An estimate of the cost to build a house can also help you visualize what your home will look like based on your budget. However, it is crucial that you estimate construction costs in a way that is reliable, even if the estimation may not be 100% accurate. How can you make a construction estimate that is reliable?

Knowing the type of material you want to use for your home is important. To get an accurate residential construction estimate, it is important to know what kind of construction materials will be needed to build or renovate your house. If you know what kind of roofing, flooring and windows you want in your home, you can compare prices at supply stores. Knowing the price of the materials for your new house will help you estimate how much it will cost to achieve a certain design. The cost of the materials is also a good indicator as to whether or not you can afford a specific house.

A reputable and experienced contractor can provide a construction estimate. You may find it difficult to estimate the cost of construction if your knowledge in home building is limited. A reputable contractor will be able to help you with your construction estimates. Contractors with years of experience in estimating costs of construction houses and structures can provide you a reliable construction estimate if you are planning to remodel or build your home.

Be aware of construction costs beyond labor and material. Don’t forget to include other costs in your construction estimate. Building a home is not just about paying the contractor and buying materials. You should also consider the cost of insurance and permit fees when you are building or renovating a home. You should make an accurate construction estimate before starting the actual construction. This will help you determine whether you can afford to build your dream house. To make an accurate construction estimate, you should know the materials you plan to use for your home. You can also consult a contractor with experience and expertise and consider other costs besides labor and material.

Ultimate Showdown – Boxing vs MMA – Clash of Combat Sports

In the world of combat sport, there are only two sports that can be considered titans. These are Mixed Martial Arts(MMA) and Boxing. Their displays of raw athleticism, talent, and courage have attracted audiences all over the world. While the two sports do share similarities, there are also distinct strategies, techniques, and cultures. In this piece, we investigate the history of Boxing & MMA.

Boxing, The Sweet Science

Sport that only focuses on punches is boxing. Fighting in the boxing rings requires precision and speedy strikes. Its roots can be traced back to ancient cultures, but boxing today is an advanced sport with weight categories and rules.

To be successful in boxing you need to avoid your opponent’s punches, while still delivering effective ones. They train to achieve speed, strength, and accuracy with their punches.

Ultimate Fighting Championship

Mixed Martial Arts (MMA), in stark contrast to boxing’s singular focus, combines several fighting disciplines. These include striking, grappling, Brazilian Jiu-Jitsu Muay Thai etc. MMA athletes use a number of techniques for winning matches. These include strikes, submits, and takedowns.

The beauty of MMA rests in the unpredictable combat style and in fighters having to constantly adapt. MMA athletes must be able balance their striking, defense and grappling. It is a constantly evolving sport, which keeps its fans on edge.

Differentiations and Debates

Boxing and MMA are always at odds. Some boxing fans argue that it is the only sport to emphasize refined striking technique, and the ability to evade. Many boxing enthusiasts point to icons like Muhammad Ali Mike Tyson Floyd Mayweather Jr.

MMA advocates, however, champion the diverse nature of the sport as well as its realistic depiction of actual combat. It is a common belief that fighters who blend multiple fighting styles seamlessly to achieve mixed martial artistry, like Anderson Silva or Georges St-Pierre are the best examples of this.

Influence on Popularity and Culture

Boxing as well as MMA are two sports that have had a huge impact on pop culture. From “Thrilla on Manila” and “Rumble of the Jungle,” the historic boxing matches are cultural icons. The Ultimate Fighting Championship is a good example of MMA’s rapid rise. It has introduced the sport to a worldwide audience, and created household names such Ronda and Conor McGregor.

Roofing To Reach: Marketing Geofencing Strategy For Roofing Contractors

Roofing businesses have benefited from the advancements of digital marketing technologies. Geofencing Marketing, amongst the various strategies available today, stands out as an effective and powerful tool. With Geofencing, you can define a virtual area and create marketing campaigns for the customers that fall within it. Here’s how roofing contractor geofencing marketing could benefit from this new strategy.

Understanding Geofencing for Roofing Contractors

A geofencing digital strategy allows roofers to create virtual fences that surround specific geographic regions. As mobile devices enter and leave geofenced zones, pre-set messages are sent to potential clients.

Why Roofing Contractors should Use geofencing for marketing.

The geofencing method of marketing roofing services can have a major impact on the industry. This allows roofing contractors to focus on specific areas, houses, or building based upon their demand for services. By geofencing, contractors can target potential clients directly and deliver targeted ads, increasing their chances of conversion.

Implementing Geofencing in Roofing:

Define Your Geofence: Establish a geographic boundary in the region where your roofing service is most likely to be needed.

Make sure your marketing messages are relevant: Use appealing, catchy advertising that speaks to your customers’ unique needs within the geofenced area.

Utilise Geo-triggered Advertising: Use geotriggers for ads that are delivered directly to your users’ smartphone when they enter the geofence. You’ll be able to place your service where you need it.

Re-evaluate and make adjustments: Regularly evaluate the effectiveness of your campaigns. You can optimize your campaigns by reviewing metrics and learning from the data.

Geofencing marketing for roofing contractors:

Targeted advertising: With geofencing, you can reach the people most likely convert. Your marketing efforts will be more efficient.

Engagement is improved: By promoting timely, relevant and interesting ads, you can increase engagement. This creates a conducive environment to cultivate leads.

Increased ROI: Geofencing tends offer higher returns due to its increased specificity of target and engagement rates.

Competitive edge: The use of geofencing can give contractors an advantage over their competitors by allowing them to take on potential clients in the region before they do.

Why Blockchain is a good technology for the luxury sector?

What is Blockchain and how does it apply to Luxury?

The luxury industry has grown over the past several years and is recovering well from the crises of the covid. In addition, many new technologies such as Blockchain have been developed. You can choose the Top NFT games for you in this site.

How can blockchain be applied in the retail and luxury sector?

Blockchain was first used in late 1990s. Bitcoin was the first major blockchain. Satoshi Nakamoto, a mysterious person from 2009 created the blockchain. This is a decentralized and accessible way of exchanging a cryptocurrency, such as Bitcoin. Bitcoin, as a currency, is unique because it has three main functions: unit of accounting, medium of exchange and store of value. In total, 21,000,000 bitcoins will be produced, not another, which may encourage people to invest in it.

It is possible to check information by using blocks of data that have been linked. This allows everyone to verify the information, without the need to ever modify it. Anyone can take part and trade bitcoin, but every bit of information that is shared will be validated by everyone in the network. The computing capacity they provide is then rewarded in bitcoin, so that everyone benefits from this system.

Decentralization is a key feature of blockchain, and it makes the system secure. No one is able to cheat or fake transactions. Everybody has a record that contains all of these transactions.

Blockchain is often associated with cryptocurrencies or financial transactions. It could also be used to improve other areas such as luxury, healthcare, and even democracy. These fields can be improved by using the technology.

In the first line, we saw that blockchain was a method of exchanging information, storing it, and then sharing it. This knowledge allows us to see that this technology can be integrated into the luxury sector, for instance, which places a high value on authenticity.

It is the materials, history, brand and exclusivity of a product that gives it value. Louis Vuitton destroys unsold items to keep prices high because they know that rare things are valuable. This is why brands can lose money by reducing sales. Increased stock, or loss of exclusiveness. When everyone is carrying the same bag, you will not feel as unique. Counterfeiting poses a serious threat to the world of luxury. The same bag can be had for less than ten percent of the original price. Although it is illegal many people choose this option because they want the prestige and quality of the brands without paying the high price. What can be done to ensure that you are buying an authentic bag, watch or shoes? Answer: blockchain.

A private blockchain, accessible only to the brand would allow us to immediately determine if an item was manufactured in their factory or is simply a counterfeit. The code would directly be associated with the blockchain.

What is a Mini Storage Auction (or Mini Storage Auction)?

Mini storage facilities or any other storage units ZH Brilliant Storage are designed to keep a person’s belongings safe and secure. It could be a short strip of mini storage units or a large sectioned warehouse. The unit management fee is paid by the owner to ensure their belongings remain safe and secure.

Mini storage space owners who fall behind in rent payments will be notified. They must pay their rent on time. If the owners do not pay the rent on time, management can take legal action to recover the losses. They will initiate the process to sell the contents. The management of the facility will need to fill out and record several documents. The management must announce that they are auctioning off the contents in a public notice at least 2 weeks before the auction. There is a legal process they must follow. It is not usually necessary if the renter is one month behind. The entire purpose of selling contents is to recoup storage rent costs.

After the mini-storage auction has been properly advertised, the auction date will be set. People will come and register to bid on mini storage items. The auction will follow. After paying the winning bidding amount, you will be the highest bidder.

There are many ways to hold mini storage and self storage auctions. Some require that you sign up to receive a number. Others may allow you to just raise bids. It’s important that you understand as much as you can about the auction before you participate. Many times, there are conditions that require the contents to be moved within 24 – 48 hours.

These mini storage units can hold a wide variety of items. You might find major and minor appliances as well as antiques and family heirlooms. You might also find boxes of jewelry or other valuable items, as well as surprises. You must bid below or equal to the transportation costs and resale prices in order to make a profit from a mini storage sale. The aim is to recoup your transportation costs and auction bid price via the resale. Any higher than those two costs combined is considered a win.

How to List Hobbies and Passions in a Resume

When writing a resume, or CV, after stating all the details about education, experience, and skills, some people find it difficult to express their hobbies and interest. Some people see this part of the resume as a chance to be different, to show off who they are, not just list their qualifications or jobs. However, many people do not know the best way to present their hobbies and interest on a résumé. Visit our website and learn more about hobbies list for adults.

Instead of listing them, you can incorporate them in a brief but interesting paragraph. Use selling words like those that should have been included earlier on your resume. For example, instead saying you like to play football, run and go to the gymnasium, say I aim to maintain a health and active lifestyle. I participate in individual sports and team games at amateur levels. It would be a perfect opportunity to describe how your teamwork on the soccer pitch can translate into the teamwork you bring to work. By doing this, you not only address your interests but have also made sure that they are relevant to the role you want to apply for.

When it comes to writing resumes, we need to consider another issue. Include hobbies and other interests in your resume only if you feel they will be of interest to readers. The inclusion of mundane, common interests does not enhance your resume. It would be more beneficial to use that space for a list of skills and achievements. As examples, hobbies and interests that are commonly listed include reading, socializing, or watching films. If you view them this way and don’t make any statements to support your statement, such as the genre of literature that is read, then these hobbies are wasted chances for selling yourself.

If you are writing a resume, always read it out loud to yourself. Try and picture how an employer would feel when reading your information. You can stand out by including a section on your hobbies and interest. The employer might not think you are the right candidate for the position, but if they see that your hobbies reveal you’ve recently climbed Everest in the past, it may make them curious enough to contact you.

Discovering the latest technological innovations: Navigating The Digital Frontier

Staying informed of the latest innovations and trends is essential in a rapidly changing technology landscape. Tech is always changing. From the most recent advances in AI to the rapidly expanding Internet of Things, it’s a world in constant flux. This Tech blog in Ghana will guide you to this new digital frontier.

Article Unraveling The Potential Of 5G Technology

As connectivity becomes the norm, 5G will transform how we work, communicate and live. This article gives a detailed look at 5G’s remarkable capabilities, such as its speed and low latency. This article explores all the industries which will be benefited by this technology. These include autonomous vehicles, smart cities and augmented realities that blend the real and virtual worlds.

The Unseen Heroes of Cloud Computing

Cloud computing is now a ubiquitous part of daily life, enabling everything from simple email to sophisticated data analysis. The ethereal clouds are a mystery. What goes on? This article demystifies complex cloud computing processes, including virtualization and serverless architecture. It also discusses security measures to protect our digital assets.

Article : AI and Beyond, Navigating Ethics of Emerging Technologies

Questions about artificial intelligence’s ethical implications are becoming more prominent as the technology continues to advance. This article explores the ethical dilemmas that surround AI. From biases in algorithms to potential job market impacts, this piece takes an extensive look at the issues. Find out how the technology community collaborates to develop guidelines to ensure that these powerful tools can be harnessed in the interest of the public.

Article : Beyond the Screen : The Evolution Of User Interfaces

The user interfaces have moved beyond the mouse and keyboard. We are changing the way we interact and use technology with voice commands, gestures, and brain computer interfaces. This article discusses the exciting journey of UI development, including the challenges and breakthroughs that are ahead.

Article on Sustainable Tech for an Eco-Friendlier Tomorrow

As environmental issues take center stage, tech companies are redefining their role in ensuring a more sustainable future. The article shows the power of technology to bring about positive change. It includes energy-efficient designs for hardware and innovative recycling techniques for electronic waste. Learn about the projects that not only reduce the impact of technology on the environment, but are also inspiring global movements towards sustainability.

This blog provides a window into the world of innovation, where technology is the driving force behind progress. As we untangle the complexity, celebrate triumphs and imagine the future, stay tuned. Come along on our exciting trip as we discover the endless possibilities of the digital world.

Delivery of prepared meals

There are many reasons why not everyone can cook a meal clicking here. The elderly and sick are the most common recipients of meal delivery services. It is essential that these individuals receive the best prepared meal delivery. This includes meals that are delicious, nutritious, on-time, and punctual. Here are some points to consider when choosing the right ready-to-eat meal delivery company.

A quality prepared meal delivery service will meet your expectations and provide the food you order. You should ensure that there is a wide variety of diabetic dishes available to the customer. It’s not fair for your friends and family to eat the same meals every day. Other meal restrictions may apply to you. If you are kosher, halal or have other special dietary requirements, we must accommodate them. Your prepared meal delivery company can’t ship pork products to any of these customers.

It’s important that a reliable prepared meal delivery company is punctual. People rely on prepared meal delivery to save time and avoid having to leave the house. Read reviews left by previous customers when searching for a company. Avoid companies with a reputation for late deliveries or non-shows. Some companies may not deliver during severe weather. Your loved ones should not be forced to eat in snowstorms. It is not possible to expect people who aren’t prepared to deliver food to the affected areas during a hurricane. However, snow should not prevent them from driving.

You should also consider the company’s range when searching online for delivery services that deliver prepared meals. The delivery company may refuse to deliver if the recipient lives in an unattractive area. Large cities that are notorious for high levels of crime have entire neighborhoods that have been designated as ‘blacklisted’. It is illegal to send couriers there. It is important to ensure that the property the person lives in does not belong on any company’s blacklist.

Now that we know what to look at when looking for a company to deliver prepared meals, let’s get out there and help our loved ones find one.

Wear Waterproof Walk Shoes to Enjoy Rainy Days

Rainy days are your least favorite? Have you grown tired of being forced to wear wet shoes to the office or wherever else? It is true that many people, just like you, are forced to walk the streets in all weather conditions. These are the times when waterproof walking boots can come in very handy. This footwear is better than ordinary shoes because it provides protection against rain and water. You can see https://blogs.ubc.ca/opinion/waterproof-shoes/ for more information.

If you follow these instructions, your feet will never be soaked in water when you arrive at your destination. It is possible to walk on wet pathways and streets. If it’s rained, the night before, then you can walk every morning despite the wet road. Even if you need to be at an important event and it rains, don’t worry about your wet feet.

Is your work requiring you to be in a wet environment for long periods? Or pass through flooded areas and passages. Do not fret, because these shoes will come to your rescue. The shoes you need are for those who love adventure and outdoor activities. You can keep your foot safe from infection, injury and any harmful substances while you are on your journey to the site.

Buy a pair of good waterproof shoes for yourself if your state is constantly wet. The shoes will come in handy if you are ever caught out with your feet getting wet. It is no longer necessary to waterproof your shoes as there are now many shops that offer waterproof footwear. Just ask the store manager which shoes are waterproof. Select shoes carefully. Talk to your family and friends about which brands are popular for these shoes. They can help you find a pair that’s of good quality that lasts a very long time. It is possible to do research yourself on the Internet about the top shoe brands.

Kotak karton: Beli Yang Benar

Ini terdengar sederhana bukan? Untuk mengirimkan produk Anda, Anda memerlukan karton. Anda dapat membeli kotak ini di toko PT Sentosa Tata Multisarana. Seberapa sulitkah itu?

Memang benar bahwa banyak hal telah berubah beberapa kali sejak 1817 di Inggris ketika kotak karton pertama, yang sifatnya bergelombang, pertama kali dipatenkan.

Kotak kardus sekarang dapat ditemukan di berbagai tempat. Dari kemasan minuman seperti susu, yogurt atau jus buah hingga berjualan makanan. Anda sekarang dapat menggunakan kardus untuk mengemas minuman seperti jus buah, susu, atau yogurt. Karena karton sekarang dilapisi, itu bisa menjadi tahan air. Ada kotak kardus untuk hampir semua hal yang dapat Anda pikirkan.

Anda dapat memiliki kotak khusus yang sudah dicetak sebelumnya, baik dengan logo perusahaan atau kertas kado Anda. Jangan kirim paket dengan kotak kardus biasa. Alih-alih, gunakan itu sebagai cara untuk mempromosikan merek Anda.

Sangat mudah untuk berpikir membeli kotak khusus dalam ukuran yang Anda inginkan dan dengan desain yang Anda inginkan akan menghabiskan banyak uang, tetapi teknologi modern telah membuat omong kosong ini. Dimungkinkan untuk membeli kemasan yang disesuaikan dan dicetak hanya dengan beberapa persen lebih banyak.

Beli dalam jumlah besar dan Anda dapat menemukan diri Anda membayar lebih sedikit untuk ukuran kotak yang sempurna daripada yang Anda lakukan untuk ukuran standar “Di luar rak”.

Jika Anda ingin mendapatkan hasil terbaik, Anda harus melakukan riset saat membeli kardus Anda.

Some Frequent Infant Considerations and particularly how Baby Therapeutic massage May also enable

Make sure you do ask for health care direction to rule out any major situations and when you may be in virtually any way nervous pertaining to your baby’s well being and fitness. The next details and points is my personal belief and expertise and will be taken as a result. I am not a overall health care professional Expert analysis on top-rated baby products, just speaking from personal sensible encounter and thru the various mothers and fathers and toddlers I have been involved with.

Colic

Ample to strike worry into any mother or father, colic is just not even a ‘real’ affliction – in that it is a phrase utilized when a infant is crying to get a extended extend of your time for no discernible intent, and regularly during the night. There may be a rule of threes – three quite a few several hours of crying more than 3 times each week, up to a couple of months of age. Seemingly you can uncover new rules – commences in just a couple weeks, for 3 months or more but among you and me I think the final two were in order to invent new treatments of three. Also often called toddler colic, childish colic or new child colic, in contrast using the horse assortment, colic just is not every day lifetime threatening – only sanity threatening. Running a screaming toddler, commonly inside the night (also called the witching hours in between 5 and eight – you notice, just every time your spouse or wife will get home so you also would really like to wind down) working day in, day out can look at the stamina of the saint. Abruptly each individual from the smug/lucky/lying mums with their angels settling at 7pm sharp next a Gina Ford-esque fashion software and eyes are solid skywards for virtually any ‘why me’ second.

Dread not! Now we have now concepts to help and downloads available. But initially I just choose to suggest you to appear to be proper just after yourselves – get Father, granny, auntie or whoever to have up the slack – five minutes of peace (unquestionably it could be Alright to wander out the front door and continue going for walks for quite a while whenever your infant is in guarded fingers) is admittedly worthy of a marvelous offer as soon as you have by now been pacing the bottom considering that tea. A therapeutic therapeutic massage, a shower, a still-hot cup of tea – all rather scarce having said that sizeable so make a even though yourself – ensure you? I might picture that online aid teams in the infant web sites may perhaps also yield a myriad of in the same way dishevelled and determined for recommendations mothers and fathers so a minimum of in the function the only real placement that may help is bolt upright from a shoulder, it is possible to surf the ‘net working with your completely cost-free hand. Sympathy might be briefly supply outside of your likewise pressured and fatigued lover so seriously truly feel freed from cost to vent to other folks as an different.

Why The new Avenia Slicer Can be a Should to possess In virtually any Kitchen area

It can be actually self-evident that a meat slicer will make a massive change in just your existence, whether it is on your ability or your modest enterprise. Just one over the “must-have” Catering Gear in today’s quick velocity daily living is often a meat slicer find this link meatslicerhq.com. Not simply could or not it’s crucial for butcheries, but will likely for business kitchens, eating areas, meals stalls while in the searching mall and unquestionably for just about any circumstances caterers.

It truly is General performance:

Meat slicers are amazing and considerably a lot quicker than slicing meat or meals by hand.

If you are fatigued of having to commit time day-to-day to the 7 days to cut up bread, meats, and cheeses for your personal lunch sandwiches or prepping for that breakfast and lunch crowd, you may limit down a while invested noticeably by turning into the Avenia Slicer which will assist. Just imagine your meat show display fridge, desk or counter decorated with all of these fantastically decrease cold-meats, cheeses and made-sandwiches.

Uniformity:

For people which have a tough time getting all all individuals cheese slices to usually be just the suitable diploma of thickness, an Avenia Slicer may help you guarantee that each slice is around the suited thickness for the liking.

Simplicity of use:

This position definitely substantially speaks for by itself. It’s just less difficult to automate a course of action like slicing several meats and cheeses through the use of a device than it really is trying to get it performed all by hand.

Will conserve Profits:

Obtaining pre-sliced meats for your restaurateurs, deli house owners, stall owners inside the grocery stores or probably a neighborhood butchery is generally likely to set you back considerably in excess of slicing them your self. After you are presently finish up filling your basket with sliced meats, cheeses, and bread it may be a superb concept to invest in an Avenia Slicer. In case you operate a butchery, the very best detail you could have to your individual Meat Display Fridge are deliciously lower cold meats; cheeses additionally your 2-minute meat slices that happen to get all evenly slash utilizing an Avenia Slicer.

Vinyl, Round Vinyl And Vinyl Decal Stickers Are Among The Products Of Resolute

Vinyl stickers have become one of the most popular stickers in today’s market. This is why the sticker printing firm offers its valued customers the best sticker prints in the world. We will tell you that vinyl, round vinyl and decal stickers are the most popular printing products on the global market. Vinyl stickers are created by using professional and artistic graphic design methods. Vinyl stickers come in stunning designs.

Vinyl stickers get special attention during the full-color CMYK/PMS process (Pantone Matching System). Vinyl stickers may also be artistically enhanced using gloss and matte finishes. Customizing vinyl stickers is not a problem for you because your online printer will customize them with great passion and enthusiasm. Printing blue is dedicated to providing the best stickers printing solutions to all of its valued customers.

With online vinyl stickers you can easily boost your business’ identity on the international market. Online vinyl stickers are a great way to get your message out there. A round vinyl sticker can increase sales as well returns for a long time. Vinyl stickers on the internet can not only relieve you of your worries about your business but also boost your productivity. Vinyl stickers are also very practical. These stickers are made of vinyl, which is an extremely strong, cutting-edge, and unique material. It is because of this that you can attach your stickers to any surface for a very long time, for example, walls, posters or billboards. A wide range of vinyl stickers are available for printing.

Today, full-color vinyl stickers are widely used in many different industries. These include the mobile phone industry and other media companies, as well fashion groups, bookshops, advertising agencies and corporate sectors. A company that offers online printing services will offer its most valued customers custom size vinyl stickers along with many incentives. These include free unlimited revisions of the design, free finishing (Glossy/Matte), and even free shipping. Full color vinyl decal stickers are outdoor advertising products that mainly concentrate on your business’s brand development. Other than vinyl decal sticker, the online printing company also offers many different printing solutions, such as business cards, greetings cards, invitations cards, door hangers, and envelopes.

Bare Metal Server: Mengapa ini adalah pilihan yang bagus untuk Cloud Hosting

Server bare metal memberikan seluruh server dan angka energinya ke satu klien cbtp. Tidak diperlukan virtualisasi atau hypervisor, sehingga Anda dapat menyesuaikan sistem agar sesuai dengan kebutuhan Anda. Pada artikel ini, kami akan mengeksplorasi alasan mengapa Anda harus menggunakan cloud server bare-metal untuk memenuhi kebutuhan TI Anda.

Komputasi awan melihat minat baru pada bare metal. Posting Tamu Tren komputasi awan yang melanda industri TI adalah cloud bare-metal. Komputasi awan memungkinkan organisasi untuk mengakses data yang disimpan di server yang dimiliki oleh pihak ketiga dari perangkat apa pun yang terhubung ke web. Manfaatnya termasuk menghemat uang, dapat mengatur sumber daya TI dengan cepat untuk kebutuhan organisasi, serta memiliki kebutuhan staf dan kantor yang lebih sedikit. Ini adalah solusi fantastis bagi perusahaan yang mencari peningkatan kinerja dan keamanan.

Ini adalah melihat lebih dekat cloud bare-metal untuk melihat mengapa itu menjadi salah satu tren TI yang paling populer.

Hypervisor dan akses langsung

Komputasi awan bekerja sebagian dengan membuat mesin virtual yang memberikan kesan kepada klien bahwa mereka memiliki akses langsung ke server. Ini dimungkinkan berkat penemuan yang disebut hypervisor. Setiap klien sebenarnya adalah satu dari sekian banyak yang menggunakan kekuatan pemrosesan server secara bersamaan. Eksekutif TI tidak memiliki banyak kendali atas server, tetapi terpaksa menggunakan sistem operasi untuk membuat perubahan pada lingkungan server. Semakin banyak organisasi menginginkan akses langsung. Karena alasan inilah popularitas komputasi awan bare-metal semakin meningkat: Anda bisa mendapatkan semua keuntungan komputasi awan dengan kemampuan beradaptasi untuk secara langsung mengatur server tempat Anda menyimpan informasi.

Peningkatan performa

Beberapa organisasi menyadari fakta bahwa menggunakan solusi penyimpanan berbasis cloud untuk data adalah cara untuk mengorbankan kinerja demi kemampuan beradaptasi. Kinerja adalah kisaran yang tidak dapat dikorbankan oleh sebagian besar perusahaan. Kinerja yang moderat dapat mengakibatkan pelanggan dan agen yang tidak bahagia, kehilangan waktu, dan penurunan pendapatan. Bare metal cloud menggabungkan kenyamanan virtualisasi dengan kecepatan dan utilitas kondisi server khusus. Layanan ini juga memungkinkan akses ke server yang lebih kuat berdasarkan permintaan.

Keamanan dan kontrol

Terlepas dari kenyataan bahwa banyak asosiasi membutuhkan fleksibilitas cloud dan skalabilitasnya, mereka enggan menyimpan data mereka di server yang belum diuji. Komputasi awan terkadang disebut sebagai model back-end “kotak hitam”. Hibrida antara komputasi awan dan penyimpanan internal telah disebut sebagai colocation. Organisasi menyimpan mesin mereka di server fisik di luar lokasi tempat staf TI mereka dapat mengontrol dan mengelola mesin.

Awan logam telanjang mengambil satu langkah lebih jauh dengan memungkinkan server khusus dikonfigurasi dari jarak jauh untuk memenuhi segala kebutuhan yang mungkin dimiliki bisnis Anda. Anda dapat menggabungkan keunggulan penyimpanan offsite dengan fleksibilitas untuk mengubah kondisi server khusus Anda.

Cloud computing menawarkan fleksibilitas dan kapasitas yang lebih besar saat ini daripada sebelumnya. Bare metal cloud adalah pilihan yang baik untuk organisasi yang ingin memiliki kontrol lebih besar atas kinerjanya, sekaligus memiliki fleksibilitas dan administrasi virtualisasi jarak jauh.

Tidak aman:

Unisecure, Perusahaan Pusat Data & Server Hosting Tier-4 di AS, Asia dan Timur Tengah dll. Kami juga menyediakan layanan hosting di semua negara bagian utama seperti new york, colorado, texas, california dll. Untuk bisnis, kami menyediakan hosting server colocation di Amerika. Selain itu, kami menyediakan hosting khusus terkelola untuk situs web bisnis, hosting vps berbasis cPanel, dan penyedia hosting web cloud.

How to Increase Your Productivity and Comfort: The Top Office Chairs of 2023

To maintain your productivity, and to feel good in today’s high-pressured work environment, you need a chair that is comfortable and supportive. There are so many office chairs on the market that finding the one you like can be difficult. Do not worry! You can rest assured that we’ve done all the work and have put together a complete list of the top office chairs of 2023. Read more now on https://blogs.ubc.ca/opinion/best-office-chair-canada/.

Herman Miller Aeron: Herman Miller Aeron has for many years been recognized as the industry standard when it comes to ergonomic seating. Its innovative features and design offer unparalleled adjustability and support. Aeron Chairs feature a customizable backrest made of breathable mesh, adjustable lumbar supports, and adjustable armrests. This allows you to customize the chair according to your specific needs. A sleek, modern design adds to its appeal. It is popular with professionals in search of both comfort and style.

Steelcase Gesture Chair. This chair is an example of Steelcase’s dedication towards ergonomic excellence. This chair has been designed to accommodate the movement of the human body in various positions. LiveBack’s technology allows the chair to adjust itself according to your spinal contours and provide optimal support for the entire day. Gesture Chairs feature 3D LiveBacks, adjustable arms, and seat cushions that improve blood circulation.

Secretlab Omega Series. The Secretlab Omega Series, for gamers as well as professionals, offers the best combination of style, durability and comfort. High-quality materials are used to create this chair, such as premium leather, cold-cured cushioning, and leather padding. These ensure long-lasting, comfortable use. Omega Series is equipped with adjustable lumbar supports, 4D arms, a tilt mechanism and multi-tilt. You can find your perfect seating position easily. Secretlab Omega Series with its customizable options and sleek design will add sophistication to any gaming or office setup.

Autonomous ErgoChair 2 (Autonomous ErgoChair 2): Autonomous ErgoChair 2 has a low price tag, but does not compromise quality. This ergonomically designed chair offers adjustable lumbar and back support as well as a mesh-backrest with ventilation. It also has a contoured, soft seat cushion. ErgoChair 2 is equipped with a tilting feature, adjustable armrests and a padded headrest. It provides comprehensive support to your whole body. Its affordable price and many impressive features make this chair a good choice for anyone looking to enjoy comfort at a reasonable cost.

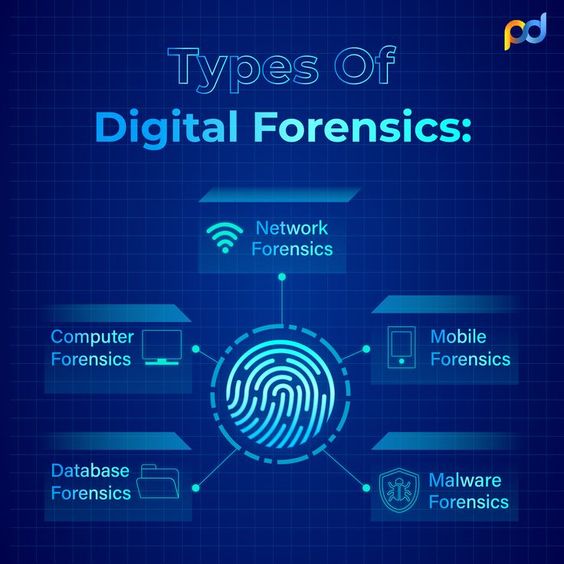

The Best of Digital Forensic Investigation Service

Many of people in this world probably wonder about digital forensic investigation service as one of unfamiliar information that they receive from a lot of websites today. We understand that people are curious in certain things and digital forensics investigation can be an impressive thing that blows a lot of people minds. Indeed, many of big companies also use digital forensic services because it is also known as one of effective method that saves their digital assets properly.

Technically, people must also notice that digital forensic services requires some of private accesses and most of them analyze sensitive information which are very confidential for some of companies. It is an important step in digital forensic investigation service to check all confidential data that affect an ongoing business system in a company. Some of people probably think that digital forensic investigation service also gives huge impacts into their personal lives.

Therefore, many of companies that handle this typical of business build solid trust with their customers so that they can develop their businesses properly. Most of companies that run digital forensic investigation services find many types of difficulties in order to create such a powerful partnership with their clients. Many of people who work in this industry also realize that they get high tensions from their clients.

They must be able to convince their clients to share a lot of important and sensitive information so that they can carry on their investigations on their client’s data base systems. Some of companies that run digital forensic investigation businesses also give suggestions for their clients at the beginning of their investigation services. It is very important for a digital forensic investigation company to educate their clients about their jobs. They must also maintain the objectivity of their client’s digital assets. The confidentiality is also one of high priority that they must maintain for their clients.

Searching For The Best Plumbers in Your Area

The best plumbers are easy to locate. On the internet, there are several websites with lists of local plumbers. Find a plumbing professional is easier now thanks to the Internet. When choosing a new plumber, there are several things to keep in mind on next page.

Check out testimonials when researching plumbers. Search for plumbers that take pictures of their work. The plumber’s reviews, endorsements and recommendations can be a good factor in choosing the right plumber.

If you pay close attention to customer reviews, it could be possible for you to save hundreds or thousands of pounds. A review, good or bad, can help you decide on the right plumber. Even the old school method of asking friends to refer you to a good plumbing company is an option.

When choosing a plumber, local directory websites can be a great resource because they have unbiased reviews as well as the qualifications of all plumbers. Be sure to use local search engines such as Merchant Circle and Angies List. These sites are reliable and will help you find local businesses. Consumers can now make more informed choices and shop around for the best price thanks to internet.

If you want to find a plumber in your neighborhood, now you know the basics. This will help you choose the perfect plumber for your specific needs. After you’ve started, the process is really easy. If you want to further narrow down the search for a plumber, look at their reviews, testimonials and certifications.

Round Rock GBP:

Moving Services are Easy to Get

Moving into a different home? For this program, have you used professional moving services before? Moving services that we can rent are very useful as they reduce the stress of moving. What is the easiest way to obtain moving services? The good news is that it’s easy to find such services. How can you do this? read next page.

Famous Movers and Moving Service Providers

For any facility, we always recommend going to the well-known service providers. The same applies to these moving service providers. These moving service providers can also be contacted at their respective offices. Known rental moving firms can be visited at the same time. These services are easy to locate and use. The famed service providers do not require any further inquiry as their services are known to be of high quality.

Why not explore your neighborhood?

Will you purchase something in distant shops if nearby markets have it? This is a no-brainer. Similarly, moving services are no different. This means that you do not have to move if the services you need are in your neighborhood. This is not something you need to worry about. They are available in all areas and can also be found near you. The second way is also very simple and saves time as well.

It is important to share your ideas and opinions.

Next, you could ask for support from your colleagues and other friends. It is important to remember that the best suggestions will solve your problem. These services are available to your friends, coworkers or family members if they’re aware and have knowledge of them. You can get moving services easily with the help of their trusted and valued opinions.

Online Moving Services are Available.

Internet is a great resource for solving all kinds of problems. Internet can be used to locate a mover, or moving company. The internet is full of thousands websites promoting a vast amount of information. There are a lot of websites that provide information about different service providers. These websites allow you access to the service information and pricing. While sitting at home, it is easy to find a professional online.

Residential Carpet Cleaning: What to Look for

Carpets can make it necessary for you to use a cleaning service. The carpets are exposed to the outside environment all day long, so dust and grime buildup is inevitable. Vacuum cleaning should be done for the first three months. It is important to keep them clean at least once a day. With time, however, vacuum cleaning might not be sufficient. To get professional carpet cleaning, you might need to call in residential cleaning services. Furniture and carpet cleaning services is done with special equipment.

Keep your carpets spotless. An accumulation of dirt or dust could pollute the environment. Unclean carpets also contribute to respiratory issues and dust allergy. The carpets should be cleaned regularly to remove dust, allergens and pollution. The options are numerous when choosing a service to clean your carpets. Searching online could be the quickest way to discover a number of options. You should know what to look for to make an educated decision.

Residential Carpet Cleaning Service: Tips on Choosing

For the best service to sanitize carpets in your home within the budget you have set, stick with the following guidelines.

It is possible to find carpet cleaners with experience in both residential and industrial cleaning. Even though it might not be a terrible idea to work with them you must check to make sure that they have the necessary experience for cleaning in residential areas. There are companies that have little or no experience cleaning residential carpets. They may focus more on commercial jobs. Either choose a firm that only specializes in residential cleaning, or a professional with sufficient experience.

It is important to choose a professional carpet cleaner who uses proper cleaning equipment. Carpets can be expensive. It could break your bank account to need to replace it due to the damage done by cleaning equipment. Online, if you want to find out what options are available for you, you should ask them about the cleaning equipment they plan on using.

Also, the cleaners should be examined before using them to clean your expensive carpets. In most cases, either a wet solution or a process of steam extraction is used. They could even use a technique that is a blend of both. In an ideal world, you would read about each of these cleaning methods to try and better understand their pros and cons. This will enable you to make a decision on what cleaning device is most suitable for your situation.

Carpet Cleaning Sydney

38 Canoon Rd, South Turramurra NSW 2074, Australia

0413 194 766

Singapore – Open up For Enterprise

Just one may well opt for any range of spots to create a company nowadays. In any case, Thomas Friedman has long gone to good detail detailing the brand new “flatter entire world.” The limitations furnished through the previous foes of length and time are already all but erased by technological innovation and eyesight. So, the reality is, business is usually efficiently conducted, for most industries, almost any place on the planet. Ahead of deciding on a organization location 1 should really have a moment to research the STEEP driving forces which will cultivate or damage the top laid designs from the most ingenious organization leaders. Coming on as the tiger of the East, Singapore is developing an economic powerhouse capable of offering one of the most fertile natural environment for organization. It really is by looking at the STEEP driving forces that one will effortlessly recognize the advantages of business enterprise in Singapore Bukit Batok West Avenue 5 EC.

Social Local climate

Singapore features an amazing variety for company. In Singapore one particular may very well be amazed because of the intermingling of immigrants; Chinese, Malay, Indian, and European persons melding into a homogenous team whilst keeping some distinctive ties to their first tradition. Identities “still stay though the bulk of Singaporeans do imagine them selves as Singaporeans, no matter race or tradition. Every single still bears its possess exceptional character” (Singapore Expats, 2007). This diversity provides organization a precious useful resource for innovation and advancement. English is greatly spoken in Singapore even so a more frequent language is “Singlish” which mixes indigenous languages with English.

Extensively spoken and understood English may be the primary language of organization. Mandarin and Cantonese are also spoken widely. You’ll find 4 major spiritual groups in Singapore. Essentially the most extensively observed are Buddhism, Taoism, Christianity and Islam as well as a variety of lesser known faiths. Interestingly, these groups interact in a constructive and interconnected way. As the teams notice their diverse spiritual festivals and holiday seasons, the community often participates during the celebrations. Singapore presents far more than a diverse, yet effectively blended workforce.

What Fences Can Do to Enhance Your Yard’s Beauty

In nature fences in austin, beauty is everywhere. It’s abundant and fragile, but it also is. If we don’t take good care of nature, it will be gone forever. Flowers, birds, insects, and sunsets are among our favorite things to see. It is for this reason that we choose to live in homes with beautiful views. We enjoy spending time with nature and walking through parks. And, of course, we cultivate beautiful gardens. Our understanding is that to continue enjoying natural beauty, we must spend time exploring and maintaining it.

We can make our gardens beautiful but they require work. And the more beautiful you want your yard to be, then the more time and effort it will take. Our gardens are beautiful because they have a great eye for colour and design. But what about the fences surrounding our garden? The fences around our gardens are often overlooked, but they can be a major part of our garden’s beauty, regardless of whether the flowers in our garden are expensive, elegant, or beautifully arranged. For your yard to look beautiful and have a garden-like feel, you should build your fence the same way you plan and plant your gardens.

It is easy to reflect nature’s beauty in your backyard by hiring a contractor who can build you a solid wooden fence, stained with high-quality sealants that bring out the natural beauty. A natural element, wood is made from the same stuff as trees. It could not be any more natural. Lighter colored stains will bring out the natural graining and knotholes in the wood. This creates a rustic, rugged look. It is durable and resistant to insects, making cedar a great choice of wood. Reddish wood is popular because of its color. The best fence contractors are not just experts in choosing the right materials. They also know the particulars of their area, such as climate, soil, pests, and local weather. It is important that the fence you choose be durable to make sure it lasts and brings the beauty of the outdoors to your backyard.

Bring Your Own ATV or Rent One?

It is possible that you will not bring an ATV along with you if you are planning a trip outdoors. Without it, however, you will miss the opportunity to ride while you are on vacation. ATV lovers, what can you do? You can still enjoy riding an ATV outdoors if you are going on a journey but don’t want to bring your ATV along with you or take enough ATVs for the whole family. You can rent ATVs in many places. This allows you to still enjoy your ATV outdoors, without the hassle of having to bring it along. To get the best out of renting, here are some tips. Visit AZ Rentals and More before reading this.

Renting ATVs isn’t cheap. But dragging your own may end up costing you even more. You may want to rent an ATV if you have to pay extra for gas just to move your heavy ATV. It may be difficult to adjust to a rental until you feel comfortable. There will never be a rental ATV exactly the same as yours. This means you can’t enjoy the trip if you don’t feel comfortable. You may not notice any difference if you don’t care too much.

Try to choose an ATV similar to what you ride. The new ATV will become easier to ride and you’ll enjoy it more. The ATV you rent should be the same or similar in size and weight to yours.

It is important to check the ATV’s safety before signing the contract. You probably already know the basics of inspecting your ATV if it is one you own. You should check that the ATV is working properly and there are no damages that could potentially lead to injury. You can determine whether an ATV you plan to rent is safe by doing a test ride. The tires must also be inspected as part of the overall safety. Make sure you have the appropriate inflation for your terrain.

As with renting a car you must always carefully read all of the information to ensure that you are aware of the rental details. You should know whether you’re responsible for the gas, and ensure that no additional charges are added after you return your ATV. You will find that some ATV rental companies offer insurance.

A Mighty Bulldozer Unleashes the Power of Earthmoving Technologies

It is a marvel of engineering and one of most famous machines in earthmoving, construction, and demolition. This is a powerful machine capable of transforming landscapes and clearing obstacles. It can also push heavy loads. This article dives into the fascinating bulldozer world, exploring its history, design and applications as well their impact on modern infrastructure development and construction. Read more now on https://dutyinsider.com/calculating-the-cost-how-much-does-a-bulldozer-cost-per-hour/.

The Evolution of Bulldozers

It is believed that the origins of the bulldozer date back to the 19th century. This was when the first tractors were introduced on the farm scene. These machines were adapted to construction work by farmers who realized their heavy-duty potential. In the early part of the 20th century, the word “bulldozer”, which refers to large, heavy duty blades mounted on tractors, became widely used.

In comparison to the advanced bulldozers of today, early models were rudimentary. To control blade movements, they relied on manual labor and steel cables. With the advancement of technology, hydraulics revolutionized how these machines functioned.

Design and Components

Bulldozers of today are marvels of modern engineering. They boast robust construction, enormous power, and sophisticated controls systems. Bulldozers are made up of several key parts.

Front Blade It is the large flat front blade that makes a bulldozer stand out. There are many types of blades, including straight blades to push material, U blades to transport loads, and even S blades which can be used both for pushing and for carrying.

Trails: In place of wheels, the tracks on bulldozers provide better stability, traction, and weight distribution. These tracks enable them to easily navigate uneven terrain, which makes them an ideal choice for construction projects in harsh environments.

Engine Bulldozers have high-horsepower engines to provide strength for the heavy jobs. They are designed to be durable and efficient, which allows the bulldozers to operate for long periods.

Hydraulic System : Hydraulics control blade movements, which allows precise adjustments. Modern bulldozers have electro-hydraulic controls which respond very accurately to inputs from the operator.

The Ripper is a feature on many bulldozers that allows them to break down hard rock or soil.

Bulldozers

There are many uses for bulldozers.

Construction : Bulldozers in the construction industry are used extensively for earthmoving, site preparation and grade. These machines clear away debris, flatten the ground, and lay foundations for roads, buildings and other infrastructure.

Mining : The bulldozer is a key tool in the mining sector. It can be used to clear overburdens and create roads for hauling materials.

Agriculture. Despite their original function, bulldozers still perform tasks in agriculture such as clearing land, building irrigation canals, and forming fields.

Forestry : Bulldozers help in the forestry industry by clearing land to plant plantations, building access roads, or managing fire lines.

CyberTend Consulting LLC

CyberTend Consulting LLC

DIGITAL FORENSICS INVESTIGATION DALLAS, TX

Serving the Entire DFW Metro Area

We are forensic consultants and investigative specialists for Intellectual Property Theft, Forensic Financial Investigations, and Business Email Compromise.

Digital Forensics Investigation requires access to private and highly sensitive information that affects businesses, communities, and peoples lives.

We know that we must establish a unique bond of trust with our clients at a difficult time. Tension is high, their confidence and privacy has been breached, and the bad actors can be either internal or external to the business.

At CyberTend Consulting LLC we are committed to earning and building that trust.

Digital forensics investigation involves the collection, preservation, analysis, and presentation of electronic data in a manner that is admissible in court. Electronic data provides clues and critical evidence to help in the discovery of cybercrimes.

This would include data theft, crypto crimes, security breaches, evidence of hacking, and more. Forensics Investigators play a key role in resolving complex data challenges.

5221 Walnut Hill Ln, Dallas, TX, 75229

214-971-8384

asingleton@cybertend.com

https://cybetend.com

This guide to successful mobile home rehab projects will help you revitalize your mobile home.

These homes are an affordable choice for individuals and their families. However, as these homes age, they may need to be rehabilitated in order for them to function better, look more attractive, or address damage. Rehab projects for mobile homes can provide homeowners with the opportunity to turn their home into something comfortable and contemporary. The steps to successfully mobile home rehab are discussed in this article.

Prior to embarking upon a mobile-home rehab project, you should assess the existing condition of the home. Evaluation of structural integrity, roof and floor, plumbing systems, electrical system, etc. Find any problems that need immediate attention. For example, water damage or mold. This assessment can help you create a comprehensive and well-organized plan by prioritizing tasks.